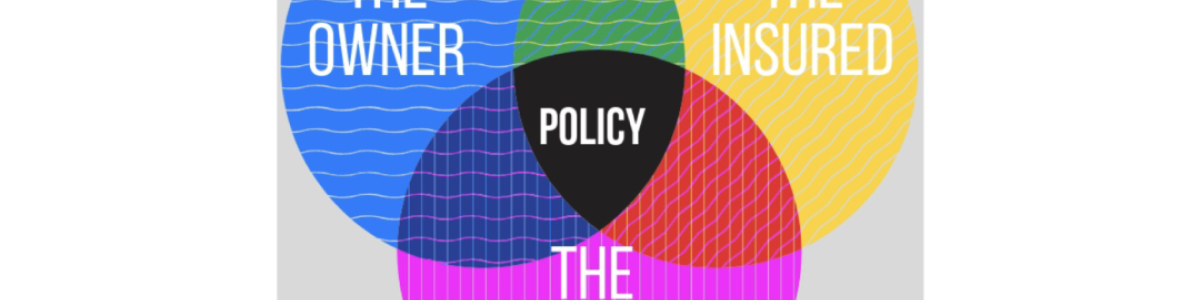

The All-Powerful Trifecta

There is an all-powerful trinity to every banking policy. No, we don’t mean “me, myself, and I,” either. For this post, we just want to remind you about the three persons that make a banking policy contract work from start to finish. Let’s talk about the owner, the insured, and the beneficiary.

The Owner

For the purposes of banking policies, this is the most powerful person involved in the contract. The owner has the ability to utilize the properties of this banking policy at all and any time he or she desires. Once the owner goes “into business” with a life insurance company through The Money Multiplier, the insurance company now goes to work for the owner, and will begin delivering benefits on the owner’s behalf. The insurance company is now the “hired help” to steward all the monetary assets. The cash value in the policy is the Owner’s to pay off debt or invest, etc. The owner has the power, and outranks anyone else. Also, be aware that the owner may or may not be a human being. An entity like an LLC or a Trust can own a life insurance policy.

Note: The money in the policy grows no matter what the stock market is doing. As of this writing, the Dow has lost all gains that have been posted in 2018!!!

The Insured

To get a policy running, the insurance company needs a human life to assign value to. As you can probably tell from the definition “life insurance” is a monetary value that gets assigned to the future economic expectancy of a person. Because the insurance company is agreeing to pay (life and death benefits) on a person’s body, they have done extensive research on tens of thousands of lives to figure out what these benefits should be. Also, the insured in a life insurance contract needs to provide a company with detail on their specific body, and the company will take that data to their actuaries and underwriters and compare it to their pool of data. Once they “guess” at how long the insured will live – or in their case – continue to make premium payments – they will deliver the benefit numbers back to the owner.

The Beneficiary

The third person in the policy trinity is the one who is named to receive the benefits after the insured dies. The beneficiary’s only responsibility is to collect the death benefit at the “graduation” of the insured person. For the banking process of The Money Multiplier Method, the beneficiary is not nearly as important to the process that we teach than the Owner and the Insured are. If and when any help is needed at the time of transferring the death benefit to the Beneficiary, we are happy to help!

Quick Facts

- The Insured can never change, but the Owner and the Beneficiary can change multiple times.

- The Owner can also be the Insured, or these can be different people.

- All three persons may assume the same, or different role in any number of additional insurance policy contracts.

When you’re ready to get started on creating your financial legacy or if you have more questions, most questions can be answered by watching this video. Start there and then schedule a consult with my team when you’re ready to begin.