Where’s My Money?

Ever feel like you’re working wayyyyy too hard for how much money is actually in your bank account? It’s so true that “there’s more month at the end of the money” for so many people in our world. We’re here to tell you where the money went.

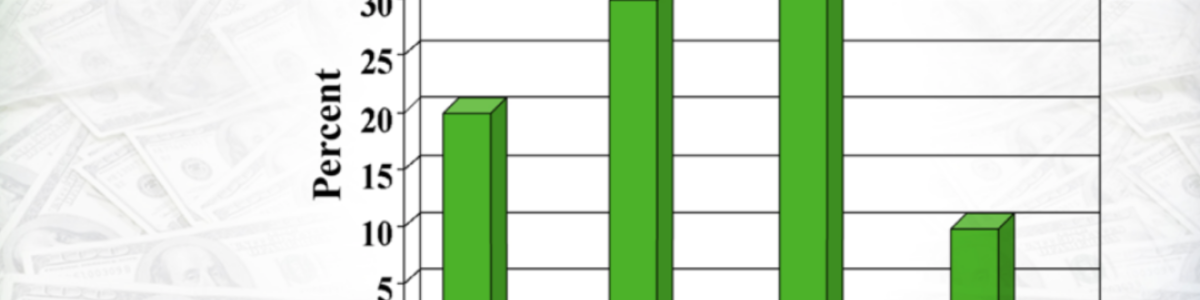

A typical double income family in the US may make around $60,000 per year. For generalities, this amount of take-home pay, would break down their annual pattern of spending like the chart below.

Annual Take-Home Income – $60,000

Cost of Autos (purchase and maintenance price) – $12,000

Cost of Housing – $18,000

Living Expenses (groceries, insurances, memberships) – $24,000

Savings – $6,000

That same family, on average, also LOSES this amount of their take home pay to their creditors and financing companies at this alarming amount! (shown in the chart below).

Financing charges of Autos – $3,000

Financing of Housing – $15,000

Living Expense Charges – $3,000

Total Interest Paid Out – $21,000

As you can clearly see, because of college debts, credit cards, vehicle financing packes, and the mortgage, the average family has $21,000 going straight out the door to third parties! That’s over 3x their savings rate, and over thirty percent of their take-home pay, every year! For the average family in our country, this percentage never changes!

It’s not just the cost of goods and services that’s killing them, it’s also the finance charges and interest! Don’t just worry about the rate (you may pay 8% or below on your vehicle or down to 3% on your mortgage), but, you’ve got to consider the volume, as well!

The man himself said it best, “You finance everything you buy — you either pay interest to someone else, or you give up the interest you could have earned otherwise.” – R Nelson Nash. Pay yourself first, recycle, and recapture all of your finance charges by following the Method of being your own personal finance company!

When you’re ready to get started on creating your financial legacy or if you have more questions, most questions can be answered by watching this video. Start there and then schedule a consult with my team when you’re ready to begin.