The Power of Uninterrupted Compound Interest

One of the best examples I use to explain the power of the Infinite Banking Concept (IBC) to my audiences is this:

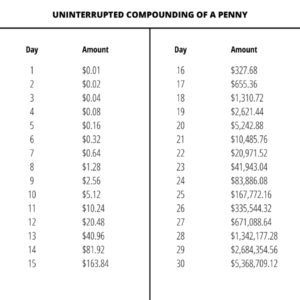

Would you rather have a million dollars OR would you rather have the sum of a penny doubled every single day for 30 days?

A million bucks sure sounds pretty good doesn’t it. At first, you may want to go with that option, but hear me out first.

Let’s do the math:

Take one penny. Double every day for 30 days. At the end of that 30 days, how much money would you have? The answer is: over 5 million dollars!

Even though it takes that penny 28 days to reach above $1 million dollars, after you hit that $1 million dollar mark, the value skyrockets every day henceforth.

So, my question to you is, what will you have in 60 days? What about 6 months? I ask so you can get the full picture of what we call uninterrupted compound interest.

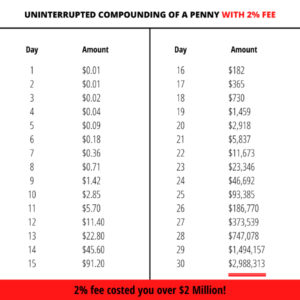

2% Fee

But let’s throw a wrench in your plans and tack on a 2% fee. You may think, “Oh, 2% isn’t bad.” But if you do the math, that 2% fee costs you over $2 million dollars in the course of 30 days.

Instead of earning over $5 million dollars, we are now down to earning just shy of $3 million dollars. All with just a 2% fee!

Many investments you make or qualified plans you have contain fees like this, with the same dire consequences to your money so it’s important for you to understand the true cost of these fees.

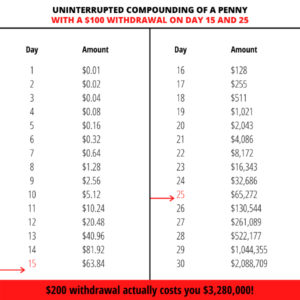

Withdrawals

Let’s take a look at another financial obstacle most people face every day, with little awareness that it actually is a financial obstacle–withdrawals. Thinking quite realistically, let’s say you need to pull out some of that “penny money” before day 30. So on day 15 you withdraw $100. Then, you make another $100 withdrawal on day 25. That’s only $200, no big deal, right? Well, after doing the math, you’ll discover that withdrawing that $200 actually cost you over $3 million dollars.

That’s right, your initial estimate of $5 million dollars was reduced by over $3 million dollars simply by taking out $200 over the course of 30 days. This is what we call interrupted compound interest and most people don’t even know how much money it’s costing them.

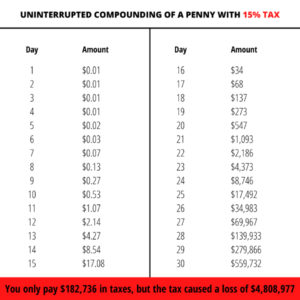

15% Tax

The third silent financial killer is taxes. Now, let’s say your “penny money” was taxed at 15% over the course of that 30 day period. You’ll see by the end of that 30 days you have only paid $182,000 in taxes BUT because that money wasn’t there to grow by doubling, that tax actually caused a loss of over $4.8 million dollars, leaving you with only $559,000.

These fees, withdrawals, and taxes are known to so many to be “no big deal,” especially if they seem relatively “low.” But their cost is far too high, many people just don’t ever do the math to discover the true opportunity cost of interrupting their compounding interest.

Yet, of all the systems we use for our finances, uninterrupted compound interest is the least used. But it is the most powerful because it allows your money to grow uninterrupted. This is the true way to grow wealth.

And this uninterrupted compound interest is what is used with IBC and with The Money Multiplier Method. But the best part about using this uninterrupted compound interest is that you still can use your money. It’s just structured in a way that allows your money to stay in your policy, without being interrupted. This makes you more money. (See this article for more details on policy loans vs. withdrawals.)